Following their initial research piece on six things you need to know about your audience during a pandemic, LAB Group, a group of agencies that centre around human behaviour and consumer neuroscience, have conducted research using Comparative Linguistics that shows how customer sentiment, trends, and behaviours have shifted massively from January to June this year.

This latest research piece digs a little deeper into retail, and fashion specifically, to discover five key findings that brands should consider, and provide some tips for incorporating these into their messaging strategy to show that they understand their audiences:

1. Customers want to feel safe

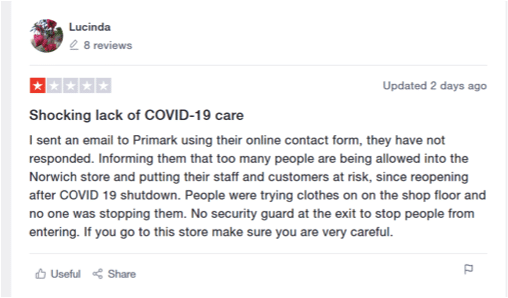

Somewhat contrary to concerns about masks impacting footfall, we saw a significant over-indexation around safety in June, as shops opened. Historically, Trustpilot is used to review services and products but now we’re seeing shops being rated on their COVID-19 measures.

Making people feel safe will undoubtedly improve customer and staff loyalty, while also helping to create brand advocates with the fringe benefit of enabling genuine word-of-mouth marketing via praise from people who are booming it across social media.

2. Fashion is seen as pointless when there’s nowhere to show it off

Fashion apathy is rife at the moment. People are 4.1x more likely to use the words “pointless”, “useless”, and “no point” when tweeting about fashion in June compared to January.

Brands will do well to curate content and push clothes that are less about presenting an image and more considered with the functional resonance of clothing – we found that people are more likely to mention “work clothes” or “proper clothes” in April than January.

3. But some still can’t stop ordering…

However, it’s not all sour news. The phrase “stop ordering” was significantly over-indexed in April.

People still clearly need their shopping fix, and retailers can capitalise on this by identifying the “can’t stop” buyers, amplifying their voice and tapping into trends around personal safety with masks, the rise of athleisure-wear for comfort, and concerns around fashion’s sustainability/ethics.

https://twitter.com/meganncee/status/1275237805329911808?s=20

4. Athleisure is no longer a guilty pleasure

On Twitter, the word “exercise” in fashion contexts was 13.5x more likely to be mentioned in lockdown (April) than pre-lockdown (January).

It’s a no-brainer to jump on the trend of athleisure for exercise but brands can also play on the rise in athleisure for working at home and balancing comfort with style.

5. Sustainability and ethics hold a lot more weight to customer choices

Mentions of “sustainable fashion” and “fast fashion” were significantly more likely to be Tweeted in June than January. In fashion contexts, people were also more likely (1.6x) to use unethical language (eg shame, evil, wrong, in trouble) in June than January.

As shown in our previous research, people are reacting strongly to the levels of customer service that brands offer customers and staff during the pandemic. Although brands should always be doing the right thing by staff and customers, our research highlights that falling foul of this in the current climate can cause permanent financial damage, with many customers stating they “will never” return, as most recently exemplified by the Boohoo pay scandal coinciding with Leicester’s lockdown.

NEVER buying from @boohoo again!! I'm absolutely disgusted that they're allowing this to happen #BoycottBoohoo https://t.co/1Mf2Yo1cZ0

— Your Bible (@LexioftheDSC) July 7, 2020

Conclusion

In the middle of a pandemic, with heightened emotions and polarised views on how we should be living, working, and socialising, it’s never been more important to get the tone right.

Brands have the unique opportunity to capitalise on changing behaviours, and create loyal customers in the wake of a period where new habits are forming. People will look to align with brands that reflect their value and tap into their sentiments.

Crucially, a tailored approach is needed to identify and influence consumers accordingly (ie the “can’t start” versus the “can’t stop” buyers). Identifying the cultural shifts and purchasing triggers is going to be the key to unlocking revenue for fashion companies.

Read the in-depth findings here.