Jaywing takes us through the impact of COVID-19 on the home and garden sectors.

Coronavirus has caused extraordinary shifts in consumer demand and behaviour. Brands have been forced to adapt their businesses, marketing, and websites at an exceptional pace.

As we’re confined to our homes, we’ve seen significant movement in the home and garden sector. Demand for furniture, DIY, decor, and garden furniture has fluctuated depending on the measures in place. Once lockdown was imposed, and imminent needs were satisfied, people began to quickly adapt to the “new normal”.

Focusing on the most tumultuous period, we have charted sector traffic by the day, plotting the impact of different measures and milestones from January 2020. Jaywing’s experts offer their insight and recommendations along the way.

Let’s delve into how the home and garden sector has been impacted.

UK top site sector traffic

About this chart:

Sector traffic data is based on SimilarWeb’s top 100 sites in each sector. The vertical axis charts the percentage of maximum visits in that sector for the date range. One-hundred per cent represents the highest traffic day in the date range. These are not absolute figures.

Key brands

We’ve charted traffic of two of the biggest brands in home and garden to view the impact of coronavirus, and how government-imposed measures impacted consumer demand online.

B&Q

Easter weekend saw record traffic levels for B&Q but the online queuing system contributed to the sharp drop-off in traffic.

Wayfair

Wayfair traffic doubled year-on-year by the end of April – hitting record levels. This is due to the size of their visibility, as well as their breadth and depth of products across the sector.

Lockdown combined with the hot weather and the Easter weekend provided the strongest traffic period for B&Q. Good Friday 2020 saw traffic levels soar, 33 per cent up on the Easter peak in 2019.

Prime Minister issues “stay at home” orders

The Prime Minister’s “stay at home” speech on 12 March triggered a wave of panic buying for “essentials” such as food, drinks, and toiletries. People stocked up through fear of being left without – as a result, non-essential purchases saw significant drops. On 18 and 19 March, home and garden sector traffic bottomed out, down 11 per cent on the previous year.

James Holding, Head of Analytics at Jaywing, says,  “Each new announcement can cause population-scale shifts in consumer behaviour. Identifying the impact of each announcement on your sector and, more importantly, understanding why behaviour has changed and for what period, will prove vital in adapting your business.”

“Each new announcement can cause population-scale shifts in consumer behaviour. Identifying the impact of each announcement on your sector and, more importantly, understanding why behaviour has changed and for what period, will prove vital in adapting your business.”

Track key dates

- Track & annotate key dates – these will be useful for analysing performance and reporting.

- Segment essential products – this will help separate them out to accurately measure performance and explain skew in reporting.

Shops close and lockdown imposed

The closure of non-essential shops on the 20 March served as a trigger for growth in the online home and garden sector as purchases had to be made online. Key purchases proved to be work from home essentials, with searches for office chairs spiking, nearly tripling year-on-year, up 180 per cent for April. The imposed lockdown on 23 March compounded the surge for essentials. Amidst the worry of coronavirus spread, demand for non-essential furniture and home items took a hit in March, sofa searches decreased by 21 per cent, and searches for prints decreased by seven per cent.

Nation of nesters

Once the initial rush to grab essentials had passed, we began nesting. We made our surroundings for the foreseeable future as comfortable and enjoyable as possible. We flocked online to get what we needed, and traffic to the home and garden sector has grown to record levels.

As we spend more time in our homes, the small discomforts grow. That light scratch on the new coffee table starts to look darker and deeper, the gaudy yellow chair in the spare room gets uglier by the day, and you’re already bored of last year’s funky feature wall colour.

People have been using their extra time spent at home to nest in many different ways; from furnishing the spare bedroom or painting the living room, to sprucing up the garden or sorting out the decking. Demand for furniture, decor and DIY products has spiked – with jobs around the home and garden being internally prioritised ahead of things we would normally prefer to spend our money on but can’t – like going on holiday, eating out or visiting friends and family.

Client Strategist Paul Norris says, “Typical seasonal trends are being bucked, and planned campaigns are no longer fitting as a result of the different wants and needs of the at-home consumer. Don’t hope for people to stumble across products on-site; push in-demand products, categories, and collections on relevant, high traffic pages and areas.”

Help the at-home consumer

- Create collections and categories for emerging trends; furniture brands should curate home office edits and work from home essentials whilst DIY retailers should look to create project based categories or product bundles.

- Configure your CMS to sort products logically in popular categories. Prioritise by popularity and availability.

- Adapt navigation to help your users find what they’re after. Made.com could have maximised their traffic by moving their Garden section into a more prominent spot on their nav – on mobile this section isn’t visible in the main nav at all.

Online pure-play giant Wayfair is one of the biggest winners of this period – with their significant investment in advertising across all channels, including TV, paying dividends. Brand searches increased by 89 per cent year-on-year in April hitting record levels of traffic, their stock surging as a result. Wayfair’s dropship model means it has the breadth and depth of hundreds of thousands of products, and isn’t subject to stock shortages of smaller retailers.

Ikea, on the other hand, saw a significant decrease in searches following the lockdown, down 18 per cent year-on-year in both March and April (before recovering in May), its famous in-store shopping experience preceding its online reputation. In an attempt to replicate their in-store service online, they innovated quickly.

Head of CRO/UX Emma Travis says, “With the doors of non-essential stores closed, many brands and retailers are thinking innovatively, and engaging through virtual experiences.”

Head of CRO/UX Emma Travis says, “With the doors of non-essential stores closed, many brands and retailers are thinking innovatively, and engaging through virtual experiences.”Offer virtual experiences

- Ikea is offering free online planning services in an attempt to replicate the in-store experience.

- Looking across to other sectors, our clients, Nyetimber, are offering virtual wine tastings with any purchase.

- ADT have switched to video consultations in place of home visits.

Consumer confidence grows

Both Ikea and Made.com saw traffic levels return to typical levels two weeks after lockdown was imposed. By the end of April, Made.com and Ikea were surpassing previous year’s traffic figures for the same period. Whilst traffic levels and search demand is picking up for furniture, are people buying? Salesfire’s network data showed furniture retailers’ conversion rates decrease by 40 per cent year-on-year (March 2020 vs 2019) before picking up in April.

AOV took a small hit, decreasing by two per cent. DIY and garden saw a 341 per cent increase in CVR and a 4.24 per cent increase in AOV.

If you were planning to buy furniture (or any delivery that doesn’t fit through a letterbox), that would have likely required taking a paid holiday (very begrudgingly). Working from home means someone’s always in. Those holding off on furniture buys are now looking to get them in whilst they’re able to. Being able to fulfill deliveries quickly and safely of course is key – search demand for next day delivery has doubled since lockdown was imposed.

Easter at home

The first weekend of April was warm, and proved to be the first tough test for some to stay indoors. However, many took this opportunity to get some DIY done (since there was no one else able to do it, and no excuse not to do it).

Easter weekend followed with even hotter weather. B&Q, Screwfix, and Wickes saw record-breaking levels of Easter traffic. Wickes and Screwfix benefited from capturing those turned away by B&Q’s online queue system and, unlike B&Q, have continued to see traffic grow since.

Traffic to the home and garden sector was down in March by one per cent year-on-year, a significant drop-off after posting an eight per cent increase in February. The combination of entering the nesting phase, improving consumer confidence, and the sunny public holidays meant April traffic soared, up 26 per cent year-on-year.

Furniture categories see Boxing Day levels of demand

Measures were relaxed slightly on 12 May, with those unable to work encouraged to go back if they can. As non-essential shops remain closed, demand for bigger ticket furniture items continues to grow. Due to the lack of FOMO, we’re instead embracing the growing trend of JOMO, the “Joy Of Missing Out,” with consumers buying bigger ticket items online. Searches for dining tables and sofas are on track to surpass peak Boxing Day levels of demand, whilst reclining chairs and lazy boys are in strong contention for the textbook “lockdown buy”, spiking significantly in mid-May.

Emerging trends and demand

The home and garden sector continues to grow. See how the demand for brands, products, and services has changed month-to-month and year-on-year.

Searches up 26 per cent YOY in April

The home and garden sector started the year well, but the combination of good weather and lockdown saw searches grow dramatically.

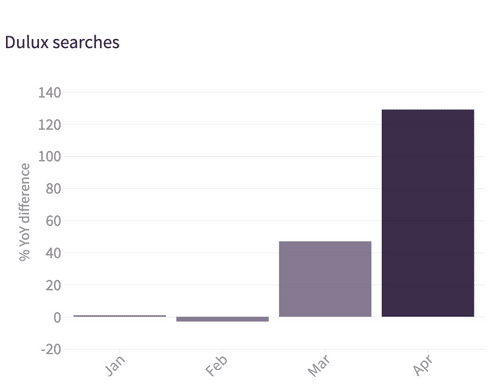

Painting – the everyman’s DIY

One thing everyone thinks they can do is paint a wall. This is shown with Dulux searches growing by over 100 per cent YOY.

Office chairs are essential

A huge spike in office chair searches picks up when people make the move to working from home and then realise the dining table chairs weren’t made to be sat in for eight hours.

Rattan revival?

Rattan chairs, previously confined to geriatric conservatories, have made a comeback. Being price effective, comfortable, and weather resistant meant they were perfect to furnish our gardens in the sun.

The garden is a room, too

The nesting urge has gone beyond the inside of the house. Garden furniture saw a huge growth this April with consumers looking to make the most of any space they had.

All hands on deck! Ha, ha, ha…

In-house DIY spread out into the garden, with those “little jobs” that everyone can do being top of the list. Jobs like oiling the decking are relatively simple, but offer great return to those making the most of their space.

Sofa interest peaks in lockdown

Lockdown is reflecting the Boxing Day-New Year fuzz. Time indoors makes people notice the state of their sofa, this time of year makes people want to refresh, whilst sales drive people to stores. We’ve seen that in lockdown as well, with people becoming significantly more interested in buying a new sofa in the Easter sales.

Finishing touches see major growth

Smaller features, like prints, also saw growth, with April’s search volume being up 50 per cent YOY. It looks like people are taking more time over the smaller details in their home, whilst a print is a fairly low-effort purchase that could have a big impact.

Online only = Always open as Wayfair grows faster than IKEA

As an eCommerce specialist, Wayfair was perfectly set to take advantage of the lockdown situation. Nesters could browse and buy all they needed for their home, and get it delivered quickly and cheaply. Ikea, on the other hand, have been playing catch-up. Their business is more modelled around the in-store experience and, as such, they were badly hit by closures. They are, however, taking steps to rectify this.

B&Q outpaces Wickes for search volume…

…but doesn’t necessarily convert it. As detailed above, B&Q had some teething problems with its online queuing system, pushing people away to competitors like Wickes. This was compounded over the Easter weekend with an increase in searches, but nowhere to go.

Adapting

Adapting your business, marketing, and website is crucial to keep up with shifting wants and needs in the home and garden sector. Some of our experts chime in on the most important aspects to focus on, from identifying trends and shifting budgets to prioritising user experience and planning ahead.

Client Strategist, Paul Norris, says, “whilst it’s no surprise that garden furniture is so sought-after right now, the great opportunity lies in being able to spot trends within trends. Interest in rattan furniture has been growing steadily consecutively now for the past five years with popularity in the wicker-looking furniture bubbling away. Lockdown and a move into the nesting phase, however, has caused search demand for rattan chairs and sofas to rocket – quadrupling within a month. Spot trends early, analyse your own site search data, search query reports and Google Trends data.”

Whilst fulfillment and delivery comes with its own problems, our Head of Paid Search, Sean Healy, discusses the opportunity for retailers to invest in paid search to capture the growing demand:

“As the saying goes ‘Make hay whilst the sun shines’ and that could not be any more true for the home and garden sector this summer as it rides on the waves of a monumental positive shift in traffic growth. Keeping supply chains fulfilled and products in stock are the biggest challenges for retailers in this sector right now, but if that is intact, now is the time to invest in paid search more than ever before.

“Successful retailers will be those that allow both the size of the current market, and their online performance, to dictate how much they budget for marketing. Use bid automation where you can. It’s responsive to auction dynamics and website performance. Avoid bid strategies that attempt to spend a set budget defined by an advertiser. Ultimately, your spend should be flexible; maximise conversions or revenue at a target CPA or ROAS which is still profitable for your business.”

Prioritising user experience on-site has never been more important than now. Whilst brands such as Ikea have acted quickly to push their planning services online and free of charge, there are a number of other ways you can communicate and reassure your site’s visitors. Our Head of UX & CRO, Emma Travis, suggests how you can do this:

“In these uncertain times, it’s really important to be as upfront and transparent as possible. Now more than ever is the time to prioritise user experience over conversion rates and, as such, reassurance about delivery should be communicated ASAP when users land (even if you’re carefully managing expectations).

“Simple messaging explaining to users that you are still operating, albeit at a delayed pace, is reassuring and encouraging.

“Made.com reassures users with messaging explaining ‘we’re still open and delivering…’, meaning users expectations are managed, and they can shop with confidence. It is definitely recommended to acknowledge the situation on-site, even if it is just to communicate that it is largely business as usual. Users will expect some form of disruption, so not acknowledging the situation will likely result in scepticism.”

Though some sectors still have a long road ahead of them before something resembling normalcy, demand is returning in many non-essential retail sectors with traffic to fashion retailers back to near “normal” levels, just two months after lockdown. Our Strategy Director John Jackson looks to other countries to see what’s next for the UK home and garden sector:

“Trying to predict what is going to happen for the home and garden sector in the next few months is getting increasingly tricky. Until a detailed plan is released by the government around leaving lockdown, it’s very unlikely we will get back to ‘normal’ within the next 12 months.

“This reflects the mood in the general public as well. A study by Global Web Index found that nearly half of consumers won’t be returning to the shops for ‘some time’ or ‘a long time’ after lockdown is eased. This means that a solid eCommerce solution is a must for home and garden sector businesses over the next few months as the intent to buy still appears to be there. When we look at something as simple as email offering open rates, we can see that they are 40 per cent higher than they were pre COVID-19. People are interested in spending, they are just more specific around how they do that.

“Germany has started to loosen its lockdown restrictions already and, as its economy looks fairly similar to the UK, it will be a good guide on how we should expect things to play out. After the initial opening which included stores up to 800sqm (and some larger furniture, Ikea, stores in the Nordrhein-Westfalen), initial signs were that consumers were not visiting in droves, with shopper levels returning to around half of their normal numbers. Consumers are cautious with their spending, as well as with returning to stores. This means that eCommerce is likely to be key for some time longer.

“With this in mind, advertising becomes more important than ever, yet businesses don’t seem to be taking their chance. Only seven per cent of brands are ‘seizing the opportunity’ and investing more in their marketing, whilst almost nine in 10 marketers are now delaying campaigns due to the crisis. With most businesses pulling back, and almost all attention on devices within the home, now is the ideal time to invest in marketing, and secure the best possible return.”