Businesses have to spend money to acquire new customers as well as retain existing ones, but the former costs a lot more. Whether investing in sales teams, strategy, or paid advertising, acquiring customers at an effective cost is how most businesses operate.

In order to fully understand what an “effective cost” is, brands need to be looking at lifetime value. This informs how much you should spend on customer acquisition and highlights any retention issues that you have.

From experience, businesses often underestimate how much a single customer is, or could be, worth at the expense of retaining customers.

What is lifetime value?

Simply put, customer lifetime value is a measurement of how valuable a customer is to your company with an unlimited time span, as opposed to just the first purchase.

Whilst not all businesses actively track retention period (they should), the calculation to workout lifetime value is actually very easy. Much of this data is also readily available within eCommerce platforms, such as Shopify, or a good CRM.

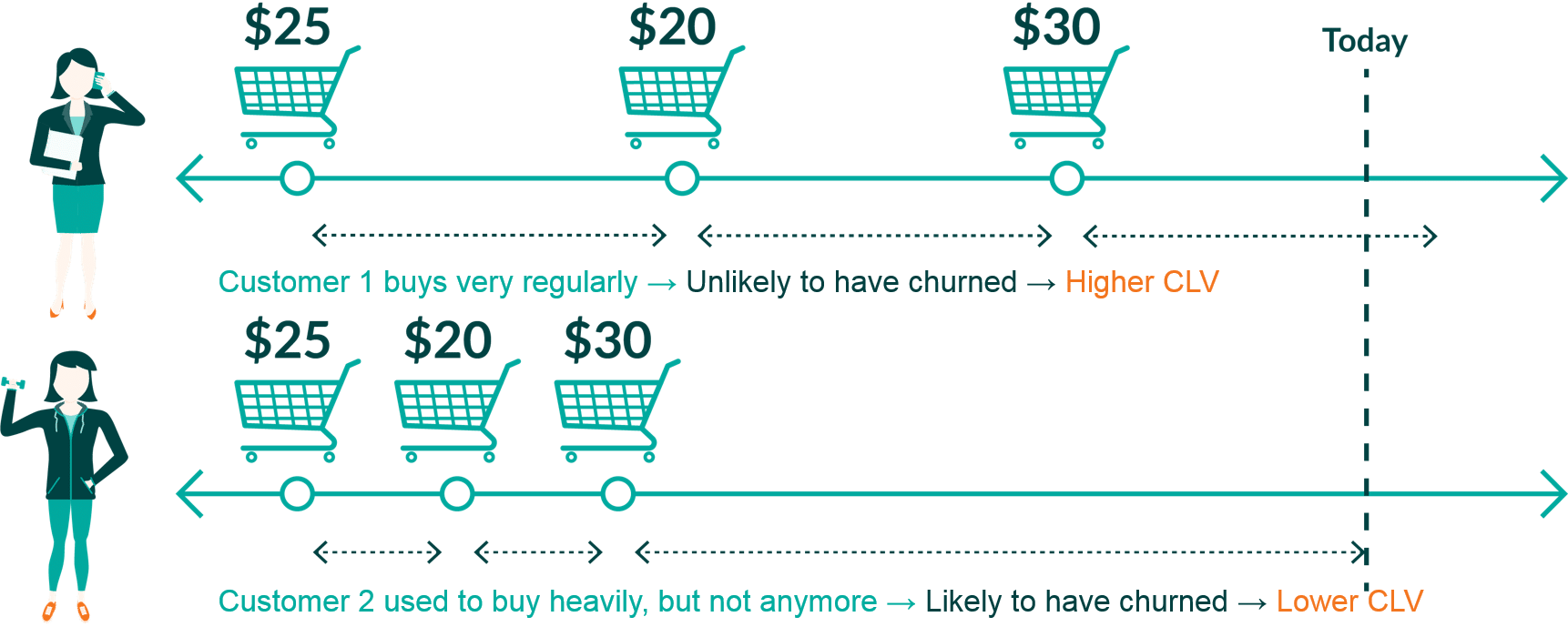

When discussing lifetime value, it is important to factor in customer life cycles, and their churn rates — which is the rate at which customers stop buying from your business. Buying behaviour is unique to every customer and business, but it is important to monitor this closely. For example, if customers are frequently churning, you need to know why. Are competitors undercutting you? Is there a lack of loyalty in the market? Or, if churn rates are low, how can you maintain this and push these loyal customers towards high-value services or products?

Measuring the rate at which customers stop coming back to your business allows for critical analysis of your current activity, which can be the first step towards further improvements in the value of your customers..

Key benefits of measuring lifetime value

By measuring lifetime value, brands can begin to put tailored programmes and customer flows in place which exist to maximise the value they provide to your business. By focusing on customer retention, brands can improve ROI, and reduce customer churn.

As an example, let’s assume your cost per acquisition for a new customer is roughly £70. If £35 is a typical average order value for a first time buyer, then we are returning at just 50 per cent, before factoring in any other costs. However, if customers on average spend £101 within the first 12 months of their initial purchase, then we begin to see the return in the long-term. When factoring in the average customer lifespan, we can make strong assumptions as to what our CPA should be.

Many brands are too focused on marketing channels, and seeing an immediate return on their spend, when they should be focusing on acquiring customers at a good cost, and doing what they can to keep them.

Of course, not all customers are created equal. Some will be worth more to your business than others, but tracking lifetime values of segmented groups is a great way to fully understand whether your cost per acquisition is correct for your goals, and the impact customer groups have on your business.

By reporting on lifetime value, performance marketers are often in a stronger position to justify their work and show that it is returning profitably, rather than making a loss on each customer. But, this also can highlight areas where improvements are needed. So, how do we go about improving lifetime value?

According to the below Criteo survey results, using data better is the number one thing businesses can do to improve their lifetime value, amongst others such as reputation.

However, I would like to focus on customer insight, increased communications, and increased personalisation. If businesses fully understand their customer (which may very well be through data use), then we can tailor our content to customers. If data shows that certain customer segments are likely to churn after six months, then personalised content via email may help to retain them. Therefore, it is likely to be a mix of the above which helps your retention (and thus lifetime value) rather than just one or two.

How can we apply this?

Customer lifetime value should be used to improve your understanding of the customer. By understanding these characteristics, businesses can hone in on key customer groups who will provide the most value to them. Knowledge of LTV allows for more accurate goal planning, more accurate CPAs, and improved reporting of return on investment.